What happens at expiry?

A call warrant will have value at expiry if the settlement level is above the exercise level. In such instances, the warrant is said to be in-the-money (ITM), and therefore will be automatically exercised on the expiry date. For example, assuming the Hang Seng futures March contract close at 20,500 points in March. HSI-C13, which has an exercise level of 21,600, is said to be expiring ITM and will be automatically exercised on the expiry date.

In contrast, a call warrant with the settlement level equal to or lower than the exercise level will expire worthless.

Put warrants, on the other hand, will carry value at expiry if the settlement level is below the exercise level. For example, assuming the Hang Seng futures March contract settle at 20,000 in March. HSI-HS whose exercise level is 21,400, is said to be expiring ITM and will be automatically exercised on the expiry date. However, it will expire worthless if the settlement level rises above the exercise level at expiry.

What is the settlement level?

For index warrants, the settlement level is the final settlement price for settling the corresponding spot-month index futures (at expiry) on the respective exchange.

- Hang Seng warrants will be settled using the settlement price of the Hang Seng futures

- China A50 warrants will be settled using the settlement price of the China A50 Futures

How to calculate the Cash Settlement Amount (CSA)?

CSA for HSI warrants = Number of Call Warrants x (Settlement Level – Exercise Level) / Exercise Ratio x HKD/MYR FX Rate

CSA for HSI put warrants = Number of Put Warrants x (Exercise Level - Settlement Level) / Exercise Ratio x HKD/MYR FX Rate

CSA for A50 call warrants = Number of Call Warrants x (Settlement Level – Exercise Level) / Exercise Ratio x USD/MYR FX Rate

CSA for A50 put warrants = Number of Put Warrants x (Exercise Level - Settlement Level) / Exercise Ratio x USD/MYR FX Rate

Example settlement calculation for HSI-C14

Expiry date: 30th March 16

Exercise level: 20,200

Exercise ratio: 900 warrants to 1

HKD/MYR on 30th March 16: 0.50 (illustration)

Settlement level for HSI futures: 20,500 (illustration)

Cash Settlement Price = [(20,500 – 20,200) / 900] x 0.50

= MYR 0.1667 per warrant

If you are holding 100,000 units of HSI-C14 after the warrant’s last trading day on 25th March (Friday), you will receive MYR 16,670 which is calculated as per below:

100,000 units of HSI-C14 x MYR 0.1667 per warrant = MYR 16,670

This warrant will be automatically exercised at 5.00 pm on 30th March and a cheque for that amount will be mailed to the relevant warrants’ holders within 7 market days from the Expiry Date. The exercise expense for all warrants listed by Macquarie are absorbed by Macquarie.

Warrants have similar characteristics to that of other equity derivatives, such as options, for instance:

- Exercising: A warrant is exercised when the holder informs the issuer their intention to purchase the shares underlying the warrant.

The warrant parameters, such as exercise price, are fixed shortly after the issue of the bond. With warrants, it is important to consider the following main characteristics:

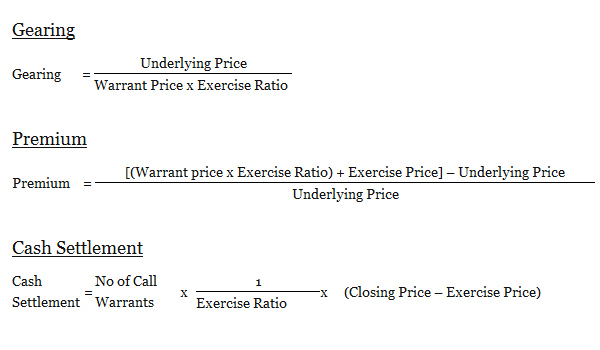

- Premium: A warrant's "premium" represents how much extra you have to pay for your shares when buying them through the warrant as compared to buying them in the regular way.

- Gearing (leverage): A warrant's "gearing" is the way to ascertain how much more exposure you have to the underlying shares using the warrant as compared to the exposure you would have if you buy shares through the market.

- Expiration Date: This is the date the warrant expires. If you plan on exercising the warrant you must do so before the expiration date. The more time remaining until expiry, the more time for the underlying security to appreciate, which, in turn, will increase the price of the warrant (unless it depreciates). Therefore, the expiry date is the date on which the right to exercise ceases to exist.

- Restrictions on exercise: Like options, there are different exercise types associated with warrants such as American style (holder can exercise anytime before expiration) or European style (holder can only exercise on expiration date).

Warrants are longer-dated options and are generally traded over-the-counter.